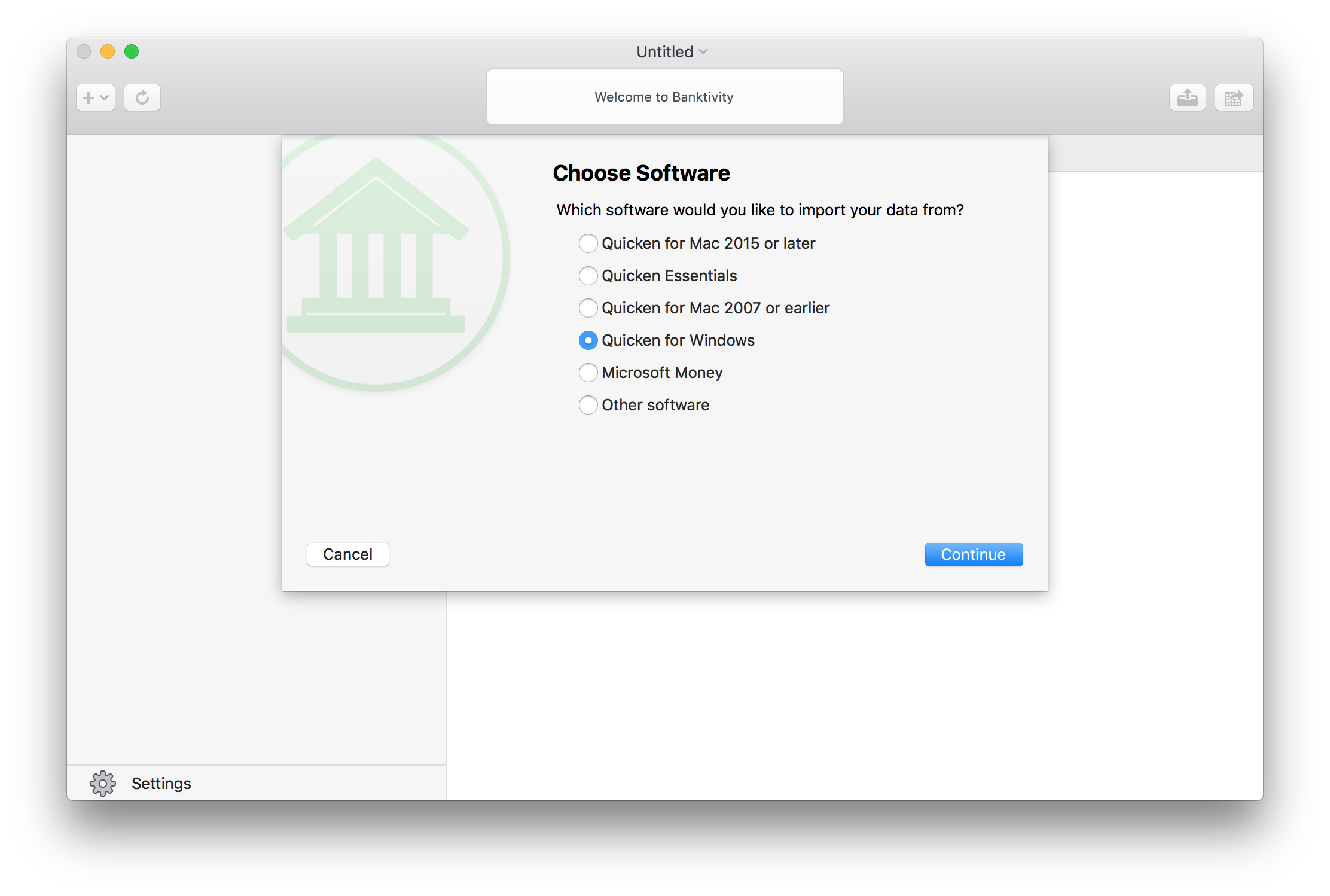

Banktivity – Intuitive personal finance manager 7.5.3. Goodbye financial stress, hello Banktivity! Banktivity lets you see all of your accounts in one place so you can make smarter financial decisions. “Over the years I have used Quicken, Mvelopes, YNAB and Mint. Recently switched to Banktivity and love it. May 03, 2017 Can Banktivity 6 import my data from Quicken? Posted on May 3, 2017 by Jon Williams. Yes, it is fairly easy to transfer data from Quicken to Banktivity. The first step is to export your accounts from Quicken in QIF or QMTF file format (please export all accounts in a single QIF/QMTF file). Then use the QIF/QMTF file to import your data into. 'Banktivity' just doesn't roll off the tongue like 'iBank') 6 to 7. Goodbye financial stress, hello Banktivity! Accurate account balances, accurate expense reporting, and a better financial picture without all the manual adjustments that I'm needing to make in Banktivity currently. Unable to add item to List. By comparison, the first two years of Banktivity would cost us $155, or $77.50 per year. If there are no more discounts after the first two years, Quicken will then cost us $5 more per year than would Banktivity, which means it would take roughly 17 years to spend the $85 we save up front.

About Banktivity: Personal Finance Software

With the advances in technology these days. It is easy to assume we rely on technology a lot more than we did 20 years ago. We can order food via the internet, pay bills, send money and control our personal banking. These days access to our personal finance are in the palm of our hand. You can access this information via smartphone, tablet or a computer. With all these modern conveniences, one thing has remained the same.

People are struggling to manage their finances. Having unlimited access to the internet maybe the cause of higher debt to income ratio. It is a lot easier to click the button to check out your cart virtually, then actually going to a physical store. This may cause people to spend more than they should.

Years ago, people would seek the opinions or advice of a financial adviser and all though that is still a valid option. Maybe your life style is too busy to actually make an appointment. Or maybe you are embarrassed about your financial situation. A modern, discreet option is an application called Banktivity.

A Brief Introduction to Banktivity:

Banktivity is available on two platforms IOS and Android. This is a personal finance management app. Using this app can help you regain control of your finances or debt. And you will always have access to it, via your smartphone. This allows use for on the go! Banktivity will show you all your expenses in one location.

Sometimes seeing how much unnecessary spending is truly occurring can give you a reality check. Because in your mind you might think $5 here or there is not that much in the long haul but over time it adds up. This app can also help you budget. It can help you pay your bills on time, if that is something you are struggling with. Banktivity can help you increase your savings by cutting out unnecessary bills or spending.

Is This Budget App Budget-Friendly?

Banktivity is an affordable option for people on any budget. But most importantly this app will offer a free trial for 30 days. This gives users the chance to try it risk free. It is truly risk free because, to gain access to the trial period, a credit card is not needed. Another neat feature about Banktivity free trial is its not limited access. A lot of apps or programs only allow for certain features during your trial. Banktivity gives you access to everything.

The only time a credit card is used is when you make the purchase of the application. The price of the app for the latest addition, which is Banktivity 7 is $69.99, and Banktivity 6 is $64.99.

It’s Top-Rated in The App Store:

Banktivity 7 is the best rated Mac app available for use for your personal finances. This app will help you better manage your finances. IGG Software is the company behind this award winning software. On their website you can read actual customer testimonials.

Many people have described the application as life changing, many were amazed at the amount of money they can save over time. It is said to be user friendly and easy to navigate.

Alternatives to Banktivity:

There are several applications that are similar to Banktivity. Some examples are Quicken 2017, Mint and YNAB. And all though these apps may help you manage your finances better. The features in these apps pale in comparison to Banktivity.

Quicken for Mac

Banktivity 6 Vs Quicken Login

Let’s start with Quicken 2019. It’s an application for Mac. It offers several of the same features that Banktivity does. However it does not offer side-by-side view of your finances. It does not allow you to browse the web within the application. It will also not show you return on investment reports or net worth reports. There are many other features Quicken 2019 does not offer that Banktivity 6 or 7 have. Even their money back guarantee window is smaller.

Mint.

The next app that can be compared to Banktivity is Mint. Once again this app lacks the ability to view reports side by side. It only allows reminders for upcoming transactions. You can not import from other apps with Mint. And it doesn’t offer a downloadable user manual. This app offers less features then Quicken 2019.

YNAB

Banktivity Vs Quicken For Mac

The final app to compare Banktivity to is YNAB. YNAB features are basic and far less extensive then Quicken 2017 or Mint. Which puts Banktivity in the winners circle. Mint appears to be the highest costing application, with different tiered pricing. But the features are far less.

Banktivity 6 Vs Quicken 2020

After all of that is seems the obvious choice, would be Banktivity. Its a simple easy to use app, that helps improve and protect your personal finances. With the help of Banktivity you could also be in the green and living with financial freedom!